The Claims Process Demystified: What To Do After A Car Accident

Regardless of your level of caution when driving, accidents and other mishaps can still happen. Having your car insured for accidents can provide peace of mind when dealing with such an unfortunate event. Your new car insuranceprovider will pay you a settlement amount if you file a claim for an accident, lessening the financial strain caused by the mishap. The details will vary based on the type of policy you have and the coverage it offers. Claims are subject to terms and conditions set forth under the motor insurance policy. *

Initiating The Claim Process

The first step after an accident is notifying your insurance provider promptly. Delays may affect the settlement process. Essential documents required include a duplicate of your insurance policy, driver’s license, car registration certificate, and the First Information Report (FIR) submitted to authorities.

Additional documents such as repair estimates and medical records are essential in case of a reimbursement claim.

See also: Top 5 Tips for Preventing Common Washing Machine Repairs

Handling The Claim Settlement Process

- Notification To Insurance Provider: Contact your insurer immediately to initiate the claims process.

- Filing An FIR: Submit a First Information Report at the nearest police station and provide a copy to your insurance company. Involving the authorities is crucial for a valid claim.

- Motor Accident Claims Tribunal: If a third party is involved, register a case with the Motor Accident Claims Tribunal to streamline the settlement.

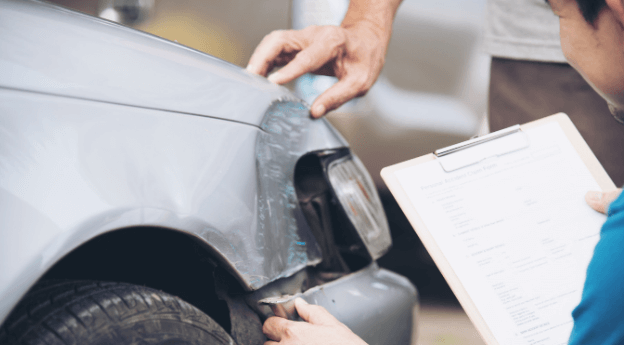

- Gathering Evidence: Documenting the accident scene through photos and obtaining witness information strengthens your claim.

- Vehicle Inspection: The insurer will assess your car’s damage to determine the settlement amount.

- Cashless Claim: Opting for a cashless claim involves the insurer arranging towing and repairs at a network garage. Reimbursement is possible if you pay for the repairs and provide the necessary receipts. Claims are subject to terms and conditions set forth under the motor insurance policy. *

Avoiding Claim Rejection

- Gather Evidence: Capture the accident scene, note witness details, and take photos to support your claim.

- Prompt Notification: Report the incident promptly to avoid claim denial based on delayed reporting.

- Complete Claim Form Accurately: Ensure accurate completion of the claim form, avoiding mistakes and inconsistencies.

- Provide Necessary Documents: Furnish all required documents promptly to prevent claim issues and denials.

- Vehicle Modifications: Inform the insurer of any modifications, ensuring they are done by professionals to prevent claim rejection.

- Avoid Consequential Loss: Refrain from using a damaged vehicle to prevent additional harm, known as consequential loss, which insurers may not cover.

- Review Terms And Conditions: Familiarise yourself with the terms and conditions outlined in your new car insurance document, understanding the dos and don’ts regarding claim submissions.

Knowing what to do in an accident or other unfortunate circumstance is critical. You can successfully file an accident claim if you know the required steps, submit all required paperwork, and keep track of any supporting documentation. By following these guidelines, you can ensure a smoother car insurance process and alleviate the financial strain caused by unforeseen accidents. Make sure you renew Bajaj Allianz car insurance online on time for uninterrupted coverage. Claims are subject to terms and conditions set forth under the motor insurance policy.

Subscribe to Bajaj Allianz General Insurance YouTube Channel here!

*Standard T&C Apply

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.